How you choose to invest your hard-earned money is a vitally important decision. The difference between a good investment, chosen based on sound advice from qualified experts, and a bad choice based on poor advice from unscrupulous operators, can be vast, with potentially major implications for your wealth.

Investment company Aisa International, operating in Czechia and providing expert advice primarily to American and British expats, is on a mission to educate the public about the dangers posed by misleading investment advice. Speaking to Expats.cz, Aisa International co-founder James Pearcy-Caldwell cited “real concerns” about insurance-regulated firms in Czechia misrepresenting themselves and their services, with potentially calamitous results for unsuspecting investors.

Knowing your MiFID from your IDD

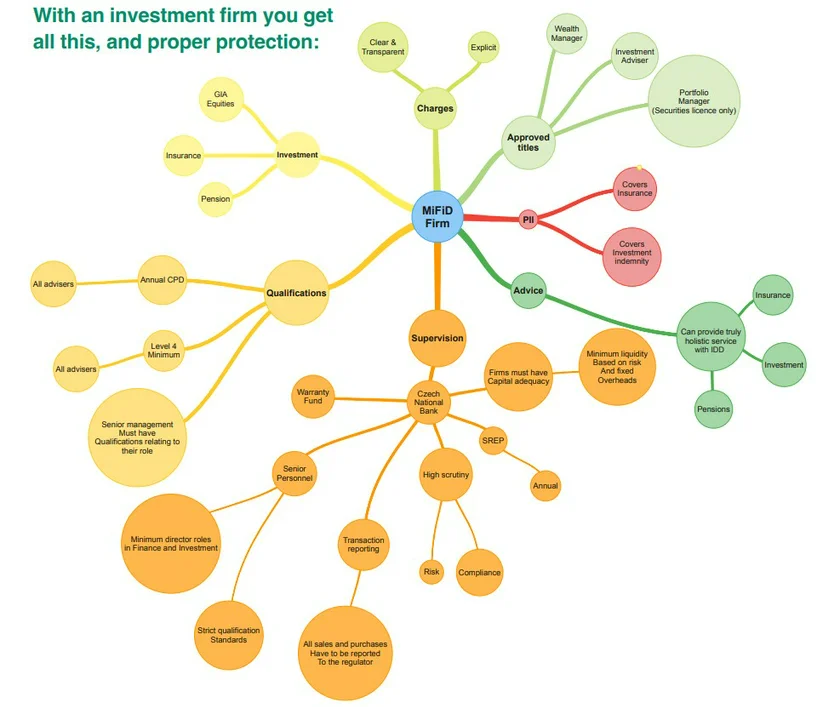

Understanding the distinction between firms with investment and insurance licenses is crucial, as they provide completely different protection levels and regulatory protections. While the abbreviations may seem perplexing, it’s vital to know that MiFID companies are licensed to provide investment advice, while IDD companies are licensed to provide insurance advice.

With insurance advisers, unbeknown to the public, passing themselves off as wealth managers or investment advisers, consumers should know which type of firm they are dealing with.

“Investment firms that hold a MiFID license help individuals grow wealth through strategic investment. Insurance firms that hold an IDD license focus on protecting against financial loss due to unforeseen events,” explains Pearcy-Caldwell.

An intricate system of regulations, licenses, reporting, and regulatory scrutiny exists to protect investors. Yet many consumers are unaware that they lose all of these essential protections by choosing an insurance regulated adviser, whose online claims, contracts and terms of business may prove worthless in the event of an emergency.

“A lot of smaller companies, especially those set up as expat advisers, tend to be insurance-based IDD companies, not MiFID investment companies. But you wouldn’t know that from looking at their propositions and websites; they market themselves as fund managers or investment managers,” Pearcy-Caldwell points out.

Don’t be misled

The difference between a MiFID and an IDD firm is more than just a technicality. Knowing the difference between these types of firms is crucial for making informed decisions about managing your financial future and for engaging with the appropriate professionals to meet your specific financial needs. After all, the risks of putting your trust in an IDD insurance firm passing itself off as a MiFID investment firm are great.

“If you pick the wrong company, you’ll have limited consumer protections, and the products in which you’re investing may not even be regulated in the Czech Republic, because they’re insurance-based,” Pearcy-Caldwell says.

“The returns are worse, too, for several reasons. In our model, based on investment practices in the UK, clients don’t pay any hidden charges or commissions, whereas here in the Czech Republic, people receive advice from insurance companies with products and funds that have completely unnecessary multiple additional charges. The advisers pushing these products would argue those charges aren’t hidden, but people don’t know that there’s any other option. The clue is when the adviser says something like ‘you pay us nothing because the provider pays us for the advice.’”

The risks of choosing an IDD firm masquerading as a MiFID firm are greatest, however, in the context of negative developments, as investors are left without protections.

“Because Aisa is MiFID regulated and has the correct professional insurance cover, as well as high liquidity and capital adequacy requirements, if the consumer were to lose money as a result of an investment going bust, that consumer could obtain compensation. With an IDD firm, which has no capital and liquidity requirements to speak of, incorrect insurance, and no warranty fund, the consumer would have no recourse,” Pearcy-Caldwell points out.

Choose a trustworthy adviser

The specific regulations tied to financial firms’ licenses are designed to protect consumers and ensure the proper handling of financial transactions. The greatest possible protection comes with a firm such as Aisa International, which holds both MiFID and IDD licenses, resulting in a full suite of protections.

Aisa is one of only a handful of such dual-licensed firms in Czechia. “We’re the only expat-focused investment firm in this country with both licenses,” Pearcy-Caldwell states. “We’re based on the US discretionary and UK investment model, which bans commissions and utilizes only so-called ‘clean funds’. We believe this is best for our clients.”

Employing certified financial advisers with decades of experience in the British, American and European investment markets, Aisa is on a mission to open up greater wealth prospects for expats in Czechia. Unlike unscrupulous, unregulated advisers who may see expats as easy prey, Aisa offers all the protections one could wish for: from full regulatory compliance, to genuine expertise in crafting customized financial plans for individual needs.

Disclaimer: Trading financial instruments carries risks. Always ensure that you understand these risks before trading.

Reading time: 4 minutes

Reading time: 4 minutes