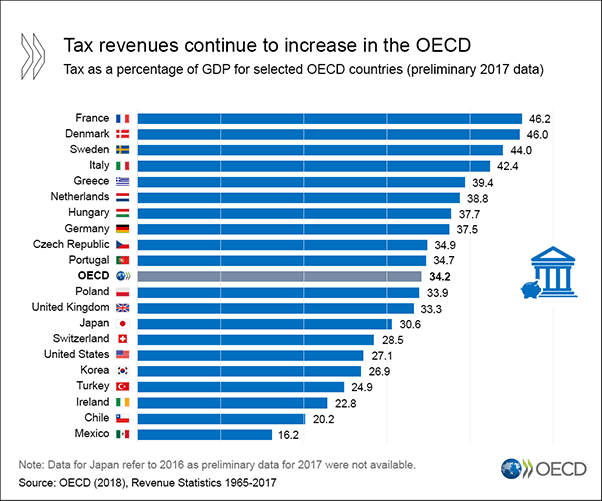

New data from the Organisation for Economic Cooperation and Development (OECD) has revealed the countries with the highest tax burden around the world.

According to the OECD, tax revenues as a percentage of GDP (i.e. the tax-to-GDP ratio) have continued to increase; the 2017 figure is the highest recorded OECD average tax-to-GDP ratio since records began in 1965.

The French pay the most annually in tax and social contributions at 46.2% followed by Denmark, Sweden, Italy, and Greece in the OECD’s ranking of tax as a percentage of the GDP.

The tax burden in the Czech Republic is above the OECD average of 34.2%, reaching 34.9% of the country’s gross domestic product (GDP). These figures land the Czech Republic (#9) among the top ten countries with the heaviest tax burden, behind Germany (#8) and above Portugal (#10).

Breaking down the numbers, Czechs pay 15% income tax; 11% is deducted from gross income for social and health insurance. In addition, employers pays 25% for social and 9% for health insurance (34% total), the highest among the Central and Eastern European countries.

Social security contributions as a share of total tax revenues were highest in Slovakia and the Czech Republic (43.5% and 42.9%, respectively).

Of the 34 countries for which data for 2017 are available, the ratio of tax revenues to GDP compared to 2016 rose in 19 and fell in 15 countries.

(Source: www.oecd.org)

Reading time: 1 minute

Reading time: 1 minute