Earlier this month, the Czech Ministry of Finance approved a three-month deferral of the deadline for natural persons and small businesses for filing income tax return and tax payments. The new deadline is July 1, 2020 while the deadline for submitting statements of income for self-employed persons was postponed to August 3, 2020.

The decision was made as a result of the current government restrictions on movement due to the coronavirus. It aims to prevent concentrations of people in government offices and post offices as well as relieve the tax burden on small businesses and entrepreneurs.

If figuring out your taxes is stressful even in the best of times, one company is not only helping expats file Czech tax returns in an English friendly format, but making some changes to their service to making life easier for tax payers during the state of emergency.

“Under normal circumstances our clients fill in the questionnaire in the app, pay, and download the tax return and statements of income in pdf format,” says Michaela Fillette an accountant at Czech Taxes Online, a service operated by the same certified accountants that run Expat Taxes.

“The client must also download the summary letter with all the instructions; print, sign the tax return and send by mail or bring personally to the tax office, social, or health office.”

Ms. Fillette says that the company is now offering individuals and businesses the opportunity to file their tax return via the company’s databox (datova schranka), meaning you needn’t file the tax return in person.

No knowledge of Czech is required to prepare the tax return via Czech Taxes Online, as the interface is fully available in English (as well as Czech and other languages). Users simply enter all their relevant tax information online and generate an official Czech tax return. Users can also choose the option for the tax return to be verified by a certified accountant.

Ms. Fillette offers us an inside, step-by-step look at how the service works:

1. Prepare the tax return via the online application at www.CzechTaxesOnline.cz

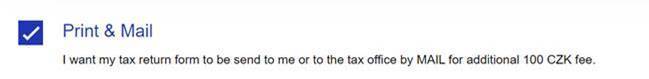

2. On the last page (“5. Summary”) tick the box Print & Mail.

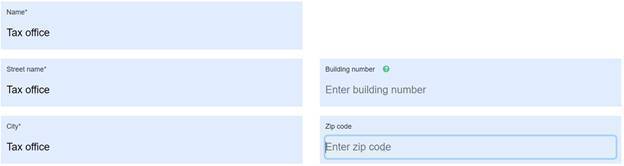

3. Write “Tax office” in all mandatory fields (marked with an *) in the delivery address-section.

4. Pay the application fee (500 CZK) plus the additional 100 CZK mailing fee.

5. Send a scan or picture of signed Power of Attorney to help@czechtaxesonline.cz together with all attachments as described in the summary letter.

Czech Taxes Online will then submit your tax return to the correct tax office via their databox and send confirmation of the submission.

The company is also offering a print and mail confirmation option in which a printed tax return can be sent to your home upon request by:

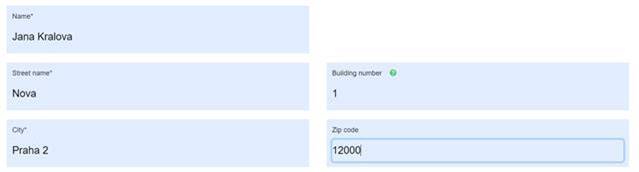

1. Filling in your address in the “Delivery Address” field in the Print & Mail option section.

Czech Taxes Online will then submit your tax return to the correct tax office via their databox and send confirmation of the submission.

The company is also offering a print and mail confirmation option in which a printed tax return can be sent to your home upon request by filling in your address in the “Delivery Address” field in the Print & Mail option section.

Czech Taxes Online will then mail your tax return to your Czech address to be submitted by you via mail or in person.

Fillette says that users can also download an XML file from the App and file through his/her databox.

She notes that the most important thing to remember is that despite the deadline extensions, “If somebody files the statement of income (Přehled o příjmech a výdajích) earlier, then the deadline, then he or she must pay the insurance within eight days of filing.”

Fillette also advises taxpayers to follow the recent changes in advance payments of social and health insurance. “Between March and August 2020 self-employed persons can lower the monthly payment of social insurance advance of 2,544 CZK and health insurance of 2,352 CZK,” she says.

This article was written in cooperation with our partners at Czech Taxes Online. Read more about our partner content policy here. Bonus: save 10% when filing your taxes by using the promo codeACCT19.

Reading time: 3 minutes

Reading time: 3 minutes