The number of mortgages taken out in the Czech Republic has reached record levels due to falling interest rates. October 2020 was the second-most successful month since 1993, when the Czech Republic was established - a record year in terms of volume is within grasp.

The volume of mortgages reached CZK 25.21 billion, according to data from Fincentrum Hypoindex, which has been keeping track of data from major banks and mortgage providers since 1993.

The average mortgage rate fell for the seventh month in a row. In October, the average rate approached the 2% mark by another five basis points, ending at 2.02%.

“Interest rates continue their downward trend and, with at 2.02%, are approaching the magical limit of 2%, which has only been broken 13 times in the entire history of the Hypoindex. The question is whether it will hit number 14 and whether it will be next month,” Jiří Sýkora, product management specialist for Fincentrum & Swiss Life Select, said in a press release.

The last time the average mortgage rate fell below 2% was in March 2017.

Compared to September 2020, the volume of mortgages in October increased by CZK 3.16 billion, and compared to October 2019, it increased by almost CZK 8.3 billion.

The last time banks saw higher volume in a single month was back in November 2016 when consumers, due to fears of a new credit law, grabbed-up mortgages worth CZK 29.68 billion.

“It's true that this year is close to reaching a new record of CZK 25.21 billion, rapidly approaching the most successful month in history. It is not surprising that the average loan amount of CZK 2,865,189 continues to rise, and has again set a new record,” Sýkora said.

The number of mortgages in October increased by almost 1,000 compared to September, to reach 8,800. Two years ago, in October 2018, banks gave over 10,500 mortgages, although the total volume though did not exceed CZK 25 billion, according to Fincentrum’s figures.

In the first 10 months of the year, banks provided mortgages amounting to CZK 197.59 billion, compared to the record year of 2017, this year’s volume so far is almost CZK 11.4 billion higher. Year-on-year, volume has increased by more than CZK 52 billion.

The high level of consumer interest in mortgages did not wane in November. To set a new record, mortgages need to reach about CZK 28 billion by the end of the year. According to Fincenturmver, topping the record volumes from 2016 and 2017 should not be a problem this year.

The Czech National Bank (ČNB) left interest rates unchanged at the beginning of November. The Ministry of Finance is not planning another general deferral of repayments, so it is likely that some clients will get into difficulties in repaying their mortgage loans. However, banks have taken a supportive attitude toward their clients, they are ready to help them and deal with repayments individually, Fincentrum stated in its press release.

The end of the credit moratorium has not yet affected mortgage rates, and due to strong competition rates may not rise in the coming months. On the other hand, the low price of resources encourages a further slight decline in rates, according to Fincentrum’s analysis. This may push the average mortgage interest rate below 2% in November.

During October, ČSOB Group, Air Bank, Fio Banka, Raiffeisenbank and Česká spořitelna reduced their mortgage rates. At the beginning of November, Creditas Bank joined them.

The Fincentrum Hypoindex evaluates the development of mortgage prices over time. It is the weighted average interest rate at which new mortgage loans for individuals are provided in a given calendar month. The input data are provided byAir Bank, Česká spořitelna, Equa Bank, Hypoteční banka, Komerční banka, Moneta Money Bank, Raiffeisenbank, Sberbank CZ and UniCredit Bank.

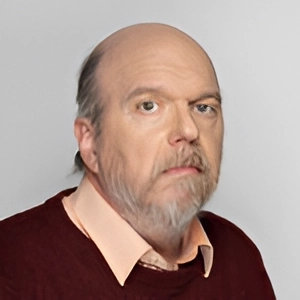

To find a Czech mortgage that is right for you, consider speaking with Tomas Jedlicka from Expats.cz Mortgage service, who can guide you through the process to find the best method and rate for your needs. His website can be found here.

Reading time: 3 minutes

Reading time: 3 minutes